-

NATIONAL

Delhi: On Sunday, there was a traffic advisory for Lord…

A warning on traffic restrictions and detours for Sunday’s Lord Mahavir Nirvana Mahotsav at Bharat…

Read More » -

-

-

-

-

UP STATE

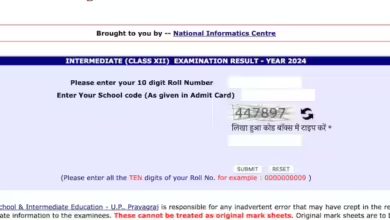

Result for UP Board 12th Grade 2024: Increase in Overall…

The UP board class 12 results for 2024 have been made public by the Uttar…

Read More » -

-

-

-

BIHAR

In Bihar, a double engine keeps breaking down; Mallikarjun Kharge…

Taking a jab at Bihar Chief Minister Nitish Kumar on Friday, Congress President Mallikarjun Kharge…

Read More » -

-

-

-

ENTERTAINMENT

A BTS clip of the upcoming song Koi Baat Nahi…

In the next song video, Koi Baat Nahi, former Bigg Boss stars Soniya Bansal and…

Read More » -

ENTERTAINMENT

Details Inside. Kalki 2898 AD: Prabhas’s New Release Date Will…

Fans have been eagerly awaiting any news on the highly anticipated science fiction picture Kalki…

Read More » -

ENTERTAINMENT

Fewer Known Details About Kalpana, the Late Kannada Actress

Kalpana is one of the most well-liked actresses in the 1990s film industry. Her career…

Read More » -

ENTERTAINMENT

Shahid Kapoor seems “hard” during his “aaj ka mood” scenes…

Actor Shahid Kapoor, who is currently filming the suspenseful action thriller “Deva,” gave his fans…

Read More »

-

INTERNATIONAL

Pakistan Rues US Sanctions On Four Companies Providing Technology To…

After the US imposed sanctions on four companies for providing missile-applicable products to the financially…

Read More » -

-

-

-

-

HEALTH

Novel immunotherapy to combat cancer and protect healthy cells

A group of US scientists has created a novel immunotherapy method that targets tumors efficiently…

Read More » -

-

-

-

LIFESTYLE

From Lung Disease To Bad Cholesterol, There Are Four Main…

Raising a toast with friends after a hard workday or to mark an event is…

Read More » -

-

-

-

SPORTS

WWE SmackDown Results: Cody Rhodes Receives Backlash From WWE

Blockbuster action filled this week’s WWE Friday Night SmackDown, which aired live from the PPG…

Read More » -

SPORTS

Gautam Gambhir tells how he ‘picked’ the WI star for…

When Sunil Narine made his ODI debut against India back in 2011, former Indian cricketer…

Read More » -

SPORTS

Dipa finished fourth in the World Cup

New Delhi: Indian gymnast Dipa Karmakar concluded her career with yet another great fourth-place result…

Read More » -

SPORTS

Dawn whistle fights juvenile screen addiction while reviving the football…

TweeeeEEEEt! At first light, the booming whistle of coach Vimal T R announces the beginning…

Read More » -

SPORTS

IPL2024: KL Rahul of LSG and Ruturaj Gaikwad of CSK…

KL Rahul, the captain of the Lucknow Super Giants, and Ruturaj Gaikwad, the captain of…

Read More »