-

NATIONAL

“What We Do Domestically, Not What We Say Internationally”: India…

In the midst of pro-Palestinian demonstrations at American colleges that have resulted in widespread violence…

Read More » -

-

-

-

-

UP STATE

LS polls: Kannauj-based SP head Akhilesh Yadav submits nomination papers

Kannauj: Akhilesh Yadav, the head of the Samajwadi Party, submitted his nomination papers for the…

Read More » -

-

-

-

BIHAR

Friday voting is encouraged, according to singer Maithili

Bhagalpur: During a candle march on Wednesday, district officials—including district magistrate-cum-district officer Nawal Kishor Choudhary,…

Read More » -

-

-

-

ENTERTAINMENT

Premiere of Heeramandi: Fardeen Khan Says, “We’re Blessed To Be…

Fardeen Khan is making a huge comeback! The Fida actor is making a significant return…

Read More » -

ENTERTAINMENT

Brian Tyree Henry has joined Pharrell Williams and Michel Gondry’s…

The ensemble of “Godzilla x Kong” actor Brian Tyree Henry has been added to the…

Read More » -

ENTERTAINMENT

“Outlander: Blood of My Blood” expands the cast by six…

News that ‘Outlander’ fans will love. Six new actors have joined the cast of “Outlander:…

Read More » -

ENTERTAINMENT

With Ryan Gostling in the lead role, director David Leitch…

David Leitch, a director and former stunt coordinator, is returning with another highly anticipated movie.…

Read More »

-

INTERNATIONAL

Iran and Pakistan finalize their free trade pact as the…

ISLAMABAD: Following the US’s warning to Pakistan about the possibility of penalties for doing business…

Read More » -

-

-

-

-

HEALTH

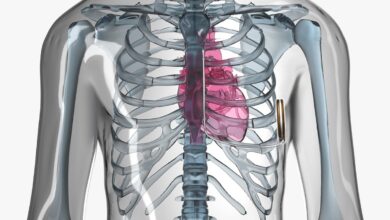

Research shows that midazolam is beneficial after cardiac arrest

Midazolam improved the chances of sufficient oxygen saturation and CO2 levels in the blood when…

Read More » -

-

-

-

LIFESTYLE

For day visitors, Venice is charging five euros to enter…

To lessen the impact of mass tourism, Venice introduced a new plan on Thursday that…

Read More » -

-

-

-

SPORTS

T20 World Cup: Ramjani thinks Ugandan players are prepared for…

Mumbai Batting all-rounder Alpesh Ramjani believes that a self-assured group of Ugandan cricket players are…

Read More » -

SPORTS

He Doesn’t Fit The Middle Order: Rishabh Pant’s New Batting…

After a game-winning knock in the 2024 Indian Premier League (IPL) match between the Delhi…

Read More » -

SPORTS

IPL2024: Rasikh Salam of the Delhi Capitals received criticism after…

Rasikh Salam Dar, a bowler for the Delhi Capitals, has come under fire for overreacting…

Read More » -

SPORTS

At 103 years old, CSK Superfan S Ramdas Is Taking…

There are fans and superfans in Chennai, but not many of them are beyond any…

Read More » -

SPORTS

For the Delhi Capitals, Rishabh Pant smashes Shikhar Dhawan’s record…

In the IPL 2024 encounter between the Delhi Capitals and the Gujarat Titans at the…

Read More »