-

NATIONAL

YS Jagan refutes political accusations and gives YSR credit for…

Jagan Mohan Reddy, the chief minister, visited Pulivendula and spoke to the people there movingly…

Read More » -

-

-

-

-

UP STATE

Unfavorable weather might affect the mango production in Uttar Pradesh:…

Lucknow: In an effort to combat the effects of climate change, specialists at the ICAR-Central…

Read More » -

-

-

-

BIHAR

Friday voting is encouraged, according to singer Maithili

Bhagalpur: During a candle march on Wednesday, district officials—including district magistrate-cum-district officer Nawal Kishor Choudhary,…

Read More » -

-

-

-

ENTERTAINMENT

“The Kindred Chronicles” Will Be Adapted Through HIP Studios—8-Letter Agreement

The epic fantasy book “The Kindred Chronicles” by David Anthony Chan is slated to be…

Read More » -

ENTERTAINMENT

“Edgar Hilsenrath the Masturbator: Inside Gaza” Pitch Projects at Sunny…

Sunny Side of the Doc, an international marketplace for documentaries, has unveiled the 42 projects…

Read More »

-

INTERNATIONAL

11 Those Found Guilty of “Terrorism” Are Executed in Iraq:…

Nasiriyah: Security and health sources said on Wednesday that at least 11 people found guilty…

Read More » -

-

-

-

-

HEALTH

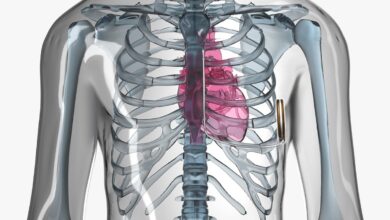

Research shows that midazolam is beneficial after cardiac arrest

Midazolam improved the chances of sufficient oxygen saturation and CO2 levels in the blood when…

Read More » -

-

-

-

LIFESTYLE

Three essential tactics that parents should know to navigate the…

Similar to how raising a toddler at home may be difficult, raising an adolescent at…

Read More » -

-

-

-

SPORTS

Watch | French President Macron wins a charitable match with…

In the Bernard Giroux stadium in Plaisir, outside of Paris, French President Emmanuel Macron scores…

Read More » -

SPORTS

Virender Sehwag Requested “GBP 10,000 A Day” of Commentary from…

One of the rare celebrities who never hesitates to call a spade a spade is…

Read More » -

SPORTS

Liverpool’s Premier League hopes are dashed after their loss to…

With a 2-0 loss on Wednesday, Everton put an end to Liverpool’s hopes of winning…

Read More » -

SPORTS

Wasim Akram denounces the trolling of Indian and Pakistani fans,…

It’s obvious that Hardik Pandya is under duress. Since taking over for Rohit Sharma in…

Read More »