-

Patient’s doctor was accused of “sexually harassing” her

In the Khandwala neighborhood here, a doctor has been reported by the police for allegedly…

Read More » -

-

-

-

-

UP STATE

UP Board 12th Exam 2024 Result: View Pass Rate for…

Today, April 20, the Uttar Pradesh Madhyamik Shiksha Parishad (UPMSP) is scheduled to release the…

Read More » -

-

-

-

BIHAR

This Bihar girl, who topped IIT, placed 66th in BPSC,…

On Tuesday, the much expected Union Public Service Commission (UPSC) 2023 test results were made…

Read More » -

-

-

-

ENTERTAINMENT

On Nysa’s 21st birthday, Kajol shares never-before-seen pictures of her…

Nysa, the daughter of Ajay Devgn and Kajol, is turning 21 today. Well, the actress…

Read More » -

ENTERTAINMENT

Court dismisses a lookout notice against the late actor’s former…

A Look Out Circular (LOC) against Samuel Miranda, the former housekeeper of late actor Sushant…

Read More » -

ENTERTAINMENT

Rohit Purohit, YRKKH Star, Is Full of Appreciation for Wife…

After stepping in for Shehzada Dhami in one of the longest-running TV series, Yeh Rishta…

Read More »

-

INTERNATIONAL

At Pennbrook Middle School, a 13-year-old Pennsylvania student attacks a…

Pennbrook Middle School had a troubling occurrence that raised questions about student safety and the…

Read More » -

-

-

-

-

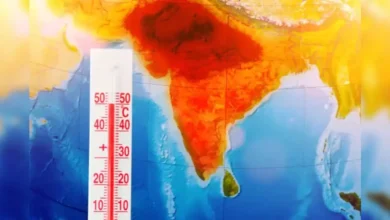

HEALTH

First Sunstroke Death Report From Odisha As Temperature Exceeds 44°C;…

A 62-year-old man passed away from sunstroke in the Balasore district of Odisha, despite the…

Read More » -

-

-

-

LIFESTYLE

Pet care: 5 suggestions for keeping your animals cool in…

Our animal companions need additional attention to be cool and comfortable on hot days. If…

Read More » -

-

-

-

SPORTS

Iga Swiatek’s Perfect 10 in Stuttgart as Coco Gauff and…

Iga Swiatek, the world number one and reigning champion, defeated Emma Raducanu in straight sets…

Read More » -

SPORTS

Roma Calls the Udinese Match ‘Hardship’ and Says It Will…

Due to their mounting domestic and European obligations, Roma criticized Serie A’s decision on Friday…

Read More » -

SPORTS

Stefanos Tsitsipas makes it to the Barcelona semifinals after saving…

Stefanos Tsitsipas, ranked seventh in the world, defeated Facundo Diaz Acosta on Friday and advanced…

Read More » -

SPORTS

Butler-Less 2024 Play-In Tournament Miami Heat defeats the Chicago Bulls…

Throughout the fourth quarter, Miami’s fervent supporters let it be known what they wanted: “We…

Read More » -

SPORTS

Juventus’s slumping team fights back to draw against Cagliari

Juventus overcame a two-goal deficit at halftime to salvage a 2-2 draw away at Cagliari…

Read More »