The listing price for Utkarsh Small Finance Bank is 60% more than the issue price

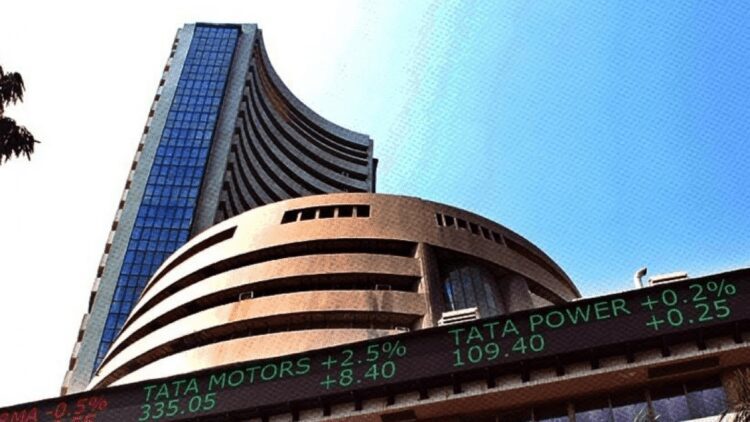

On Friday, Utkarsh Small Finance Bank Ltd. made its stock market debut at a premium. The Utkarsh Small Finance Bank shares was launched on the National shares Exchange (NSE) for Rs. 40 per share, or 60% more than the issue price. The stock debuted on the Bombay Stock Exchange (BSE) for Rs 39.95 a share.

The subscription period for the Utkarsh SFB public issue began on Wednesday, July 12, and ended on Friday, July 14. The business set the pricing range for the planned initial public offering (IPO) at Rs 23 to Rs 25 per equity share.

Utkarsh Small Finance Bank reached an intraday high of Rs. 47.94 per share during the session, up 20% from its listing price and 91.76% from its issue price.

An enthusiastic investor response led to a solid listing, with the IPO achieving an oversubscription of approximately 102 times at close.

Retail investor quota was subscribed to 72.1 times, non-institutional investors 81.6 times, and qualified institutional buyers (QIBs) part 124.8 times.

The bank received Rs 222.75 crore on July 11 from 20 anchor investors. The business said in its exchange filing that the distribution of 8.91 crore equity shares to anchor investors, at a maximum price range of Rs 25 per share, was finalized.

The anchor investors included the ICICI Prudential Mutual Fund (MF), Edelweiss Mutual Fund, Aditya Birla Sun Life Mutual Fund, Goldman Sachs, Massachusetts Institute of Technology Basic Retirement Plan Trust, Kotak Mahindra MF, and others.

According to the red herring prospectus (RHP), the Utkarsh Small Finance Bank IPO is a totally fresh offering of equity shares totaling up to Rs 500 crore with no offer for sale (OFS) component. Each equity share has a face value of Rs. 10.00.

The money will be put to use raising the bank’s Tier 1 capital base and covering future capital needs.

Kotak Mahindra Capital Company Ltd. and ICICI Securities Ltd. are the public offering’s book running lead managers. As the issue’s registrant, KFin Technologies Ltd.

The firm recorded total revenue of 2,804 crores for the fiscal year 2023, while net profit for the same time was Rs 404 crores.