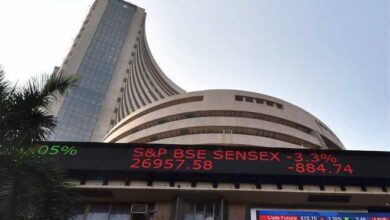

Today’s stock market meltdown: BSE Sensex fell more than 530 points, costing investors Rs 5 lakh crore; the main causes of the bear assault

Today’s stock market crash: On Monday, trading saw sharp drops in the key Indian equity indexes, the BSE Sensex and Nifty50, before they began to partly recover. The BSE Sensex fell by 800 points, while the Nifty50 was trading close to 22,300.

The BSE Sensex was down 532 points, or 0.72%, at 73,713.11 at 11:53 AM. Nifty50 was down 154 points, or 0.68%, at 22,365.85.

As with Asian markets, Indian stock markets began the week with a decrease.

Iran’s retaliatory strike on Israel soured investor confidence and sparked worries about a possible regional confrontation.

To reach Rs 394.68 lakh crore, the overall market capitalization of businesses listed on the BSE decreased by Rs 5 lakh crore.

Sector-wise, Nifty Auto, Financial, Metal, Pharma, and Oil & Gas began with losses ranging from 1-2%, while Nifty PSU Bank, Realty, and Media started with drops of more than 2%.

Why today’s declines in the BSE Sensex and Nifty50

Iran killed seven Iranian Revolutionary Guard Corps members, including two generals, in a drone assault on Israel on Saturday night, allegedly in revenge for an alleged Israeli attack on its embassy in Damascus on April 1. Both the Sensex and Nifty had large losses on Monday in the wake of Iran’s military strike, as investors voiced concern over the possible fallout from the assault on Israel. Investor prudence is warranted given that the market is now at an all-time high. According to Kranthi Bathini of WealthMills Securities, “geopolitical tensions have the potential to cause a swift market reaction, and we’re closely monitoring how the situation unfolds” (ETMarkets).

Following Iran’s Saturday firing of explosive drones and missiles towards Israel, MSCI’s Asia-Pacific shares outside of Japan fell 0.7% as Asian markets began the week warily. Australia’s S&P/ASX 200 index dropped 0.6%, Hong Kong’s Hang Seng Index plummeted 0.8%, and Japan’s Nikkei plunged more than 1%.

As traders modified their expectations for the speed and scope of this year’s rate decrease by the Federal Reserve, US Treasury rates stayed around their recent highs. The benchmark yield on the 10-year note was 4.5277%, while the yield on the two-year note was close to 5%, at 4.8966%.