CA discusses house loan patterns over the last 60 years for three generations, igniting internet discussion

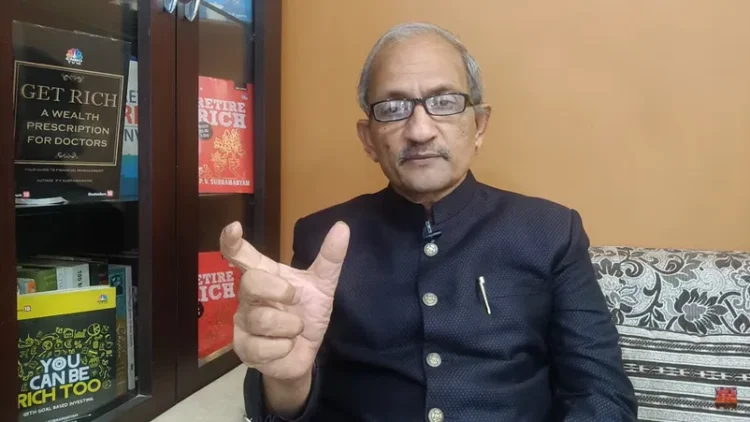

New Delhi: A Chartered Accountant (CA) spoke with X about the historical 60-year tendency of taking out loans to purchase a home. CA PV Subramanyam discussed how he, his father, and his nephew pooled income and took out loans.

“In 1966, my father purchased a home with a substantial debt of Rs. 28,000. In 1981, I took out a big debt of Rs. 2,50,000 to purchase a home. Subramanyam tweeted, “My nephew recently borrowed Rs. 2.6 crores (year 2023) to buy a house.”

Internet users respond

“To have 48k in 1966 is 39,50,000 in today’s income,” said one user. Dad was not of the middle class. Furthermore, your 1981 pay of 2 lakhs per month is equivalent to 59,23,000 now. My buddy, you came from a family in the top middle class. 7.37% rupee inflation rate from 1966 is assumed. “2 lacs annually in 1981 was 10 times the average middle class income,” another commenter said.

“It’s quite interesting to see the significant increase in house prices over time, reflecting the impact of inflation and the growth of the real estate market,” a third user said. It is evidence of how the economy is evolving.

“Your dad was the wisest to limit loan amount to less than a years salary,” someone said in a remark. “Your father borrowed less than his annual salary, you borrowed a little more, and your nephew borrowed twice his annual salary,” said yet another poster. It would be interesting to see whether Bangalore and other metro areas exhibit this tendency or if Tier 2 and Tier 3 towns do not.